Board Composition and Functions

WT has established a corporate governance structure to manage the company’s business in accordance with the Company Act, the Securities and Exchange Act and other relevant laws and regulations of the Republic of China. We have been strengthening the company’s performance and responsibility, and balancing the interests between stakeholders in pursuit of long-term interests of shareholders.Under the Board of Directors, there are Audit Committee, Remuneration Committee and Risk Management Committee. The Risk Management Committee is composed of three Independent Directors, the Chairman and the Chief Financial Officer. Its role is to review risk management policies and management reports on major risk issues, oversee corrective measures, and routinely report the implementation of risk management to the Board of Directors.

In May 2019, the Board of Directors appointed Kerry Hsu, senior vice president, as the head of corporate governance, responsible for organizing the meeting schedule and agenda of the Board of Directors and shareholder meetings, assisting directors in their training plans, providing directors with information needed to perform duties in compliance with laws and regulations, and disseminating information to directors on a regular or occasional basis, depending on the topic, to strengthen corporate governance functions.

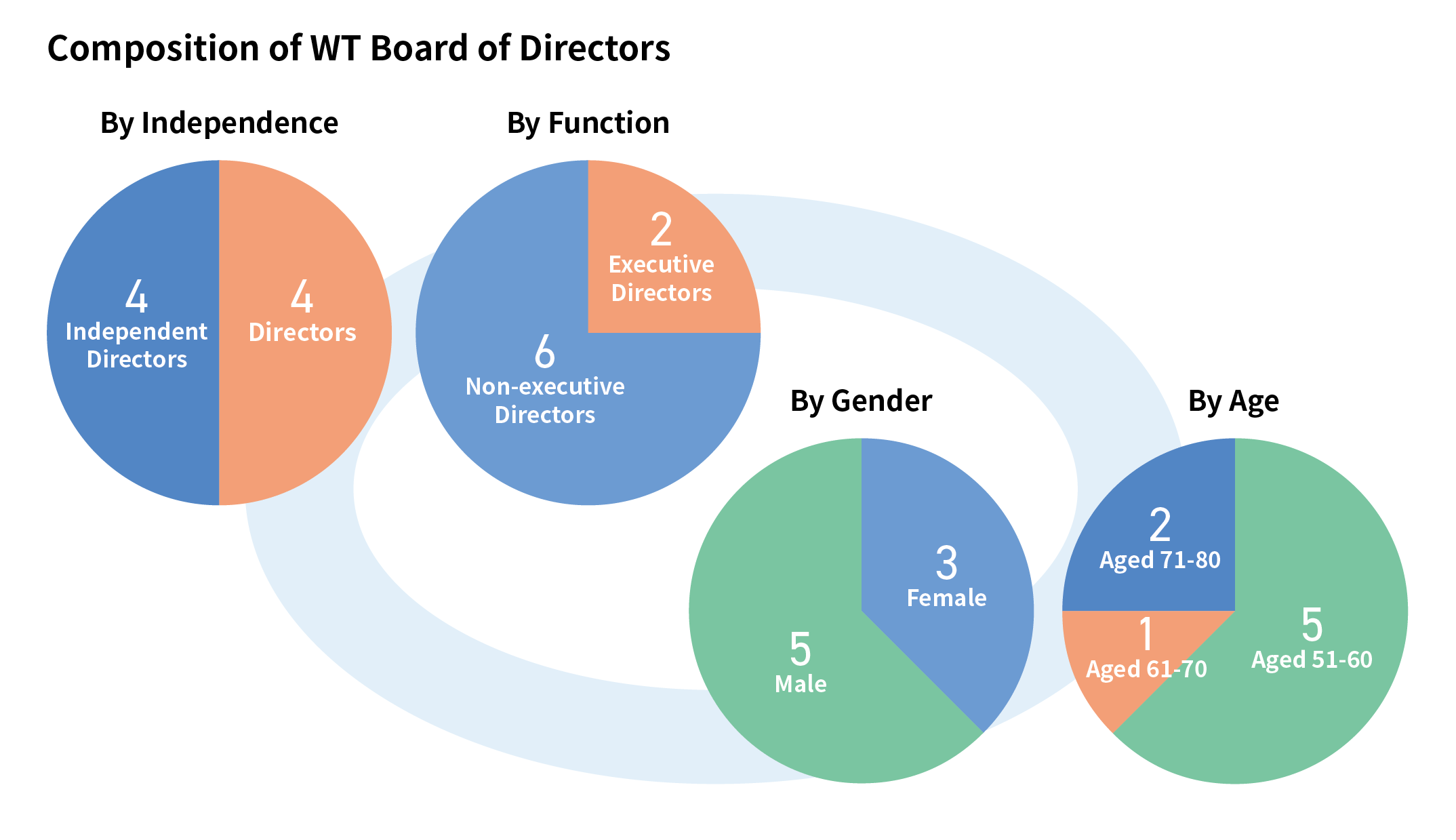

Diverse Board with more than 40% of the directors being women

The Board of Directors is WT’s highest governance body. The tenth terms of Board was elected on May 20, 2022, is composed of four Directors and three Indepentent Directors. In order to strengthen the sound development of corporate governance, the policy of diversity is implemented in accordance with the Corporate Governance Best Practice Principles formulated by WT. Of the Board Members, there are three Independent Directors (43%), three female Directors (43%), and two Directors are employees (29%). In addition, four of the current directors are aged from 51 to 60 years old, one from 61 to 70 years old, and two from 71 to 80 years old. For the implementation of the Board Member diversity policy, please visit the corporate governance section of the WT official website.

The Board of Directors meets at least once a quarter to monitor the achievement of the Company’s operational goals and performance, provide strategic guidance to the management team, and oversee the Company’s compliance with laws and regulations to ensure the best interests of shareholders. In fiscal 2022, the directors’ in person attendance rate at the thirteen Board meetings was 98.9% on average, and the Independent Directors’ was 100%. Conflicts of interest with directors are avoided in accordance to the provisions of Article 15 of WT’s Rules of Produre for Board of Directors’ Meeting. Meeting items involving a director’s interests are disclosed in the annual reports, with the names of the director involved, the content of the item, and the reasons for avoiding conflicts of interest. In addition, information such as the existence of a controlling shareholder, and related party transactions are all disclosed in the annual report to avoid or reduce the possibility of conflicts of interest.

For information on the diversity of the Board of Directors, the Audit Committee, the Remuneration Committee and the Risk Management Committee, including the members’ age range, experience, tenure, as well as information on their in-person attendance rate at the Board meetings, status of continuing training and education, and how conflicts of interest have been avoided or handled in 2022, please see Chapter Three Report on Corporate Governance in the Annual Report 2022.

Basis for effectiveness assessment of the Board of Directors and the functional committees

In order to implement corporate governance, improve the function of the Board of Directors, and establish performance goals to strengthen the operational efficiency of the Board of Directors, WT has formulated the Rules for Board of Directors Performance Assessments in 2016, which clearly stipulates that the Board of Directors and the functional committees should routinely conduct internal self-assessment every year. An assessment evaluation must also be preformed once every three years by an external professional independent organization or an external team of experts and scholars. The assessment results must be reported to the Board of Directors, and be used as a reference to determine individual directors’ remuneration payment and nomination for the Board re-election.

Internal Self-Assessment

The internal self-assessment questionnaires for the entire Board of Directors, individual members of the Board of Directors, individual members of the Audit Committee and individual members of the Remuneration Committee for the year 2022 were completed in January 2023. The results indicated that the Board of Directors and the functional committees were functioning well.

External Assessment

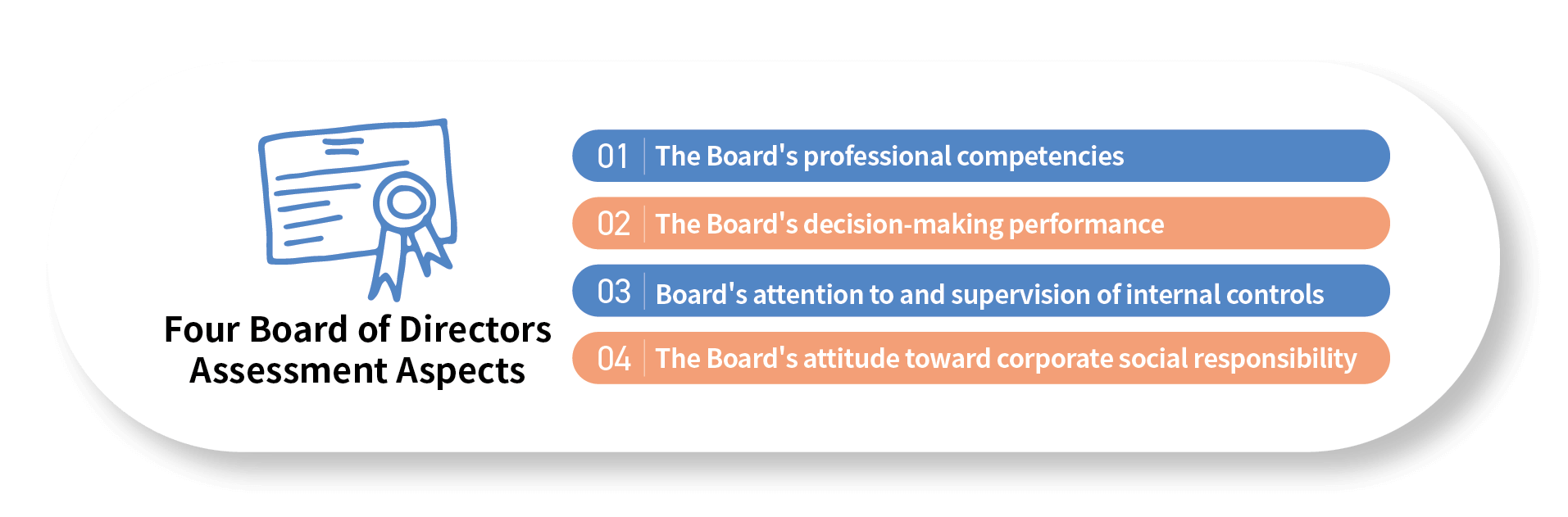

In 2020, an external professional organization, the Taiwan Institute of Ethical Business, was commissioned to conduct the effectiveness assessment of the Board of Directors for 2020. The Institute and its executive experts have no business dealings with WT and thus are independent. The assessment was conducted through document review, questionnaires and on-site interviews in four major aspects, including the Board’s professional functions, decision-making effectiveness, attention to and oversight of internal controls, and attitude toward corporate social responsibility. The assessment recommended that the communication improve between the Board and the management team and the Board pay more attention to corporate social responsibility issues (known now as sustainability issues). In response to the recommendations, the corporate governance department took the initiative to collect questions raised by individual Directors and pass them on to the management team. When necessary, relevant managers were invited to attend the Board meeting to explain to the Directors.

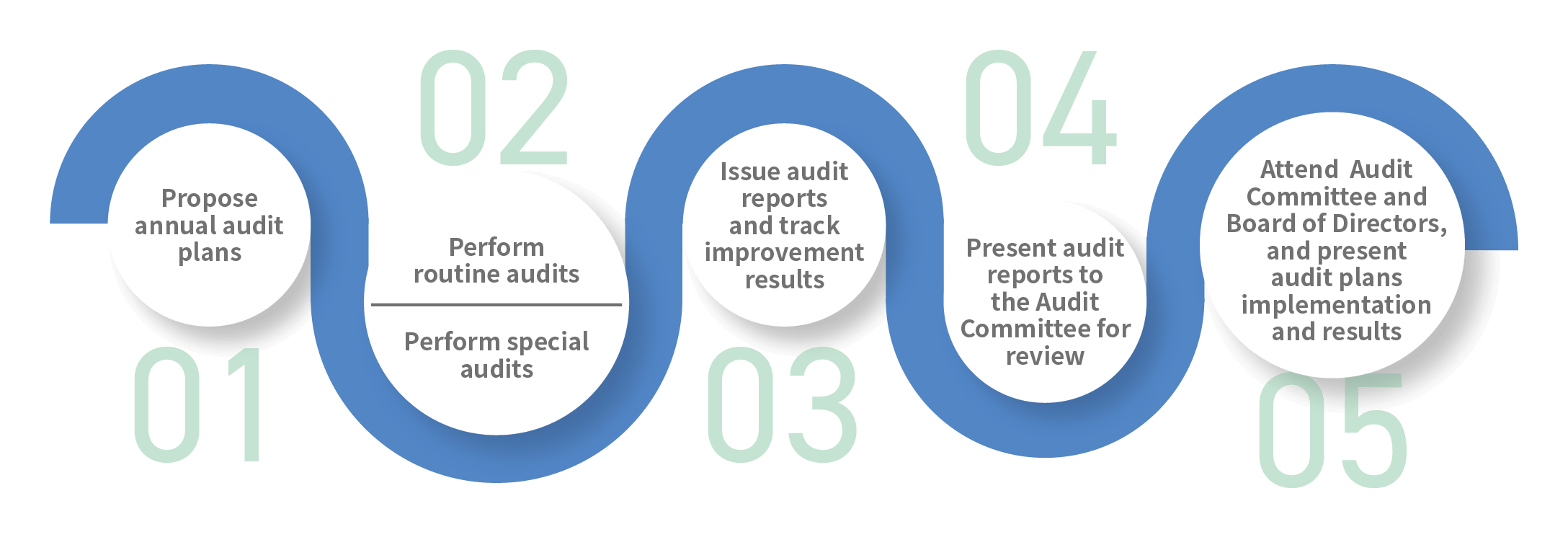

Rigorous internal audit to ensure fairness and impartiality

In WT Microelectronics, the Internal Audit Department (referred to as “the Department” hereunder) is an independent unit under the Board of Directors. The appointment and dismissal of the company’s internal audit supervisor are approved by the Audit Committee and passed by the Board of Directors. The appointment/dismissal, evaluation/review, salary/compensation of internal auditors of the Company are handled in accordance with the Corporate Governance Best Practice Principles ,shall be submitted by the chief internal auditor to the Board Chairperson for approval and to evaluation and review at least once a year.

The purpose of internal audits is to assist the Board of Directors and managers in inspecting and reviewing defects in the internal control systems, measure operational effectiveness and efficiency, and to make timely recommendations for improvements to ensure the sustained operating effectiveness of the systems and to provide a basis for review and correction.

Implement self-monitoring to strengthen the system

The Department shall implement regular auditing based on the annual audit plan, which is passed by the Board of Directors and based on the identified risks. The Department shall also implement special audit plans separately based on actual needs. After implementing each audit, the Department shall present the audit reports and follow-up reports, and submit them for review by the Audit Committee before the prescribed statutory date. The officer of the Department shall attend and deliver a report on the situation of each audit plan to a regular board meeting.

The Department shall supervise all internal departments and subsidiaries to conduct self-assessments once a year and implement the company’s self-monitoring mechanism. The Department shall adjust the design and implementation of the internal control system in a timely manner in response to changes in the environment.The Departments shall review the self-inspection reports and evaluate the overall efficacy of all internal control systems to serve as the primary basis for the Board of Directors and General Manager to produce Internal Control System Statements.

To reduce the possibility of conflicts of interest between the Chairman and the other Directors, WT discloses information including the content of the items, the names of the interested Directors, and reasons for recusals in the annual reports, as required by Article 15 of the Rules of Procedure for Board of Directors’ Meetings. In addition, in compliance with the requirements of Taiwan Stock Exchange Corporation Operation Directions for Compliance with the Establishment of Board of Directors by TWSE Listed Companies and the Board’s Exercise of Powers, at least half of the Board Members are Independent Directors, and more than half of them are neither employees nor executives. Every year, WT arranges for each Director to attend professional director courses provided by external organizations such as Taiwan’s Securities and Futures Institute to improve the Board’s operational effectiveness. To implement corporate governance, Independent Directors may provide input and make suggestions in each functional committee for the Board’s information. In addition, information such as the existence of controlling shareholders and related party transactions is disclosed in the annual reports.

To reduce the possibility of conflicts of interest between the Chairman and the other Directors, WT discloses information including the content of the items, the names of the interested Directors, and reasons for recusals in the annual reports, as required by Article 15 of the Rules of Procedure for Board of Directors’ Meetings. In addition, in compliance with the requirements of Taiwan Stock Exchange Corporation Operation Directions for Compliance with the Establishment of Board of Directors by TWSE Listed Companies and the Board’s Exercise of Powers, at least half of the Board Members are Independent Directors, and more than half of them are neither employees nor executives. Every year, WT arranges for each Director to attend professional director courses provided by external organizations such as Taiwan’s Securities and Futures Institute to improve the Board’s operational effectiveness. To implement corporate governance, Independent Directors may provide input and make suggestions in each functional committee for the Board’s information. In addition, information such as the existence of controlling shareholders and related party transactions is disclosed in the annual reports.