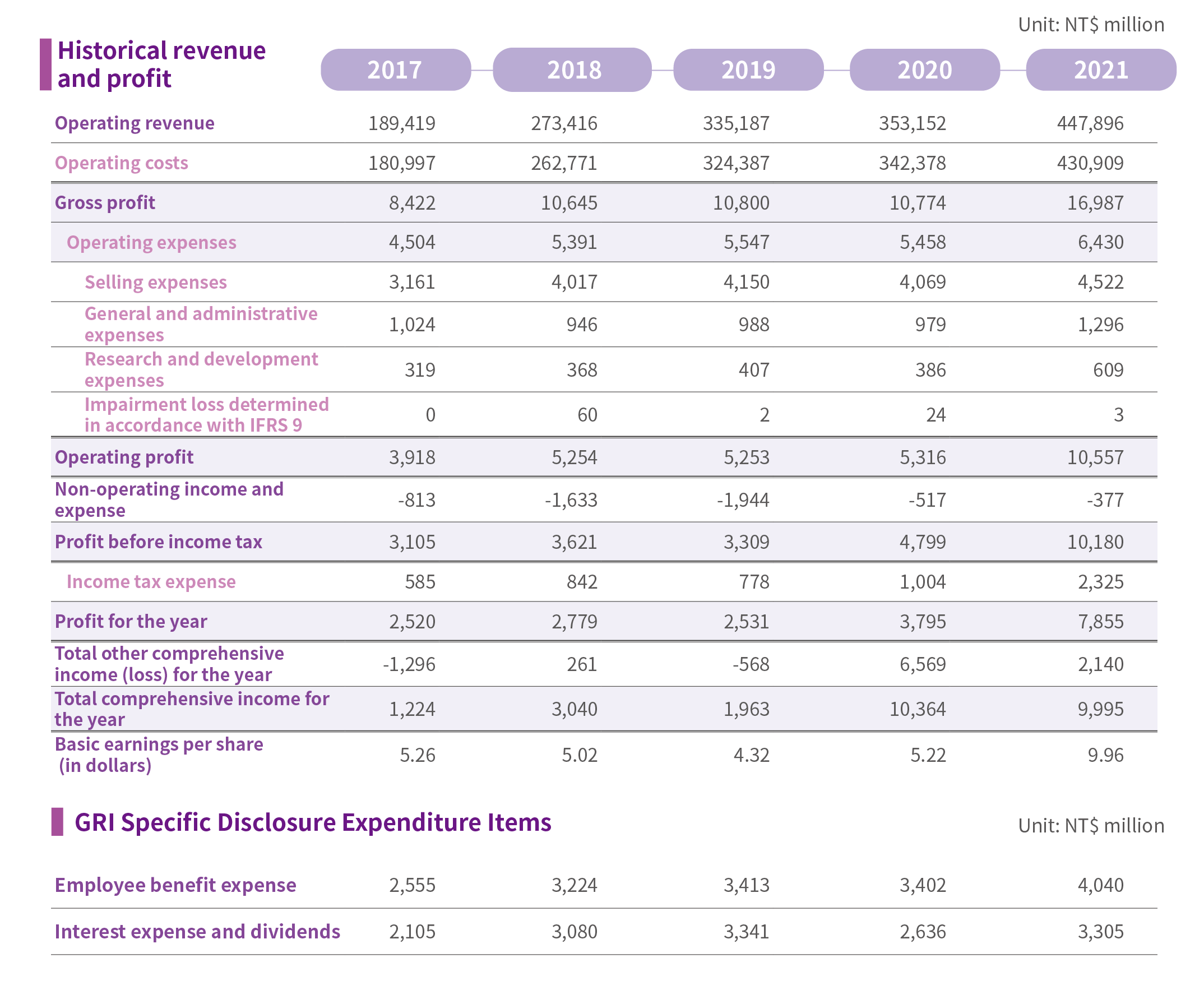

WT's consolidated net operating revenue was NT$959.4 billion in 2024, an increase of NT$364.9 billion or by 61%, from 2023. The net profit was NT$9.2 billion in 2024 and EPS was about NT$8.13 based on weighted average outstanding shares.

Operating Revenue and Profit, 2020-2024 (in NTD million)

|

|

Generative AI (GenAI) to accelerate long-term demand growth in the semiconductor market

In 2024, the global semiconductor industry continues to face headwinds from a weak macroeconomic environment, high inflation, and elevated interest rates. Despite these challenges, WT has demonstrated strong resilience by capitalizing on the surge in semiconductor demand driven by GenAI, leading to significant revenue growth. Looking ahead, amid global economic uncertainties due to geopolitical tensions, the rapid advancement of GenAI technologies, and ongoing transformations in the electronics supply chain, WT will leverage its integration with Future Electronics to further strengthen its global footprint in the electronic components market. With the goal of continuously expanding market share and improving profitability, WT will also enhance operational management systems and risk controls to boost efficiency. By deepening its ability to deliver added value across the electronic components supply chain, WT aims to build a sustainable operating foundation.

Revenue percentage of sustainable economic activities increased by 2.64 percentage points

WT systematically manages the environmental impact and application areas of its product portfolio, with a focus on supporting customer transitions to sustainable product design. Through targeted services and technical support, the company enables customers to integrate energy-efficient and low-carbon solutions across diverse application markets. In alignment with the Sustainable Economic Activities Recognition Reference Guidelines (Version 2), published by Taiwan's Financial Supervisory Commission on December 31, 2024, WT assessed its existing product applications to identify those that qualify as sustainable economic activities. These include solutions in low-carbon transportation, high-efficiency industrial equipment, and renewable energy infrastructure. In 2024, revenue derived from sustainable economic activities accounted for 14.07% of total revenue – an increase of 2.64 percentage points from 2023. These categories reflect not only compliance with regulatory expectations but also alignment with global sustainability trends. Looking ahead, WT is committed to further investment in clean technologies and low-carbon solutions. The company has set a target to increase the share of revenue from sustainable economic activities to 20% by 2030, supporting its long-term ESG strategy and enhancing its contribution to global decarbonization efforts.