A sound board structure and operational mechanism

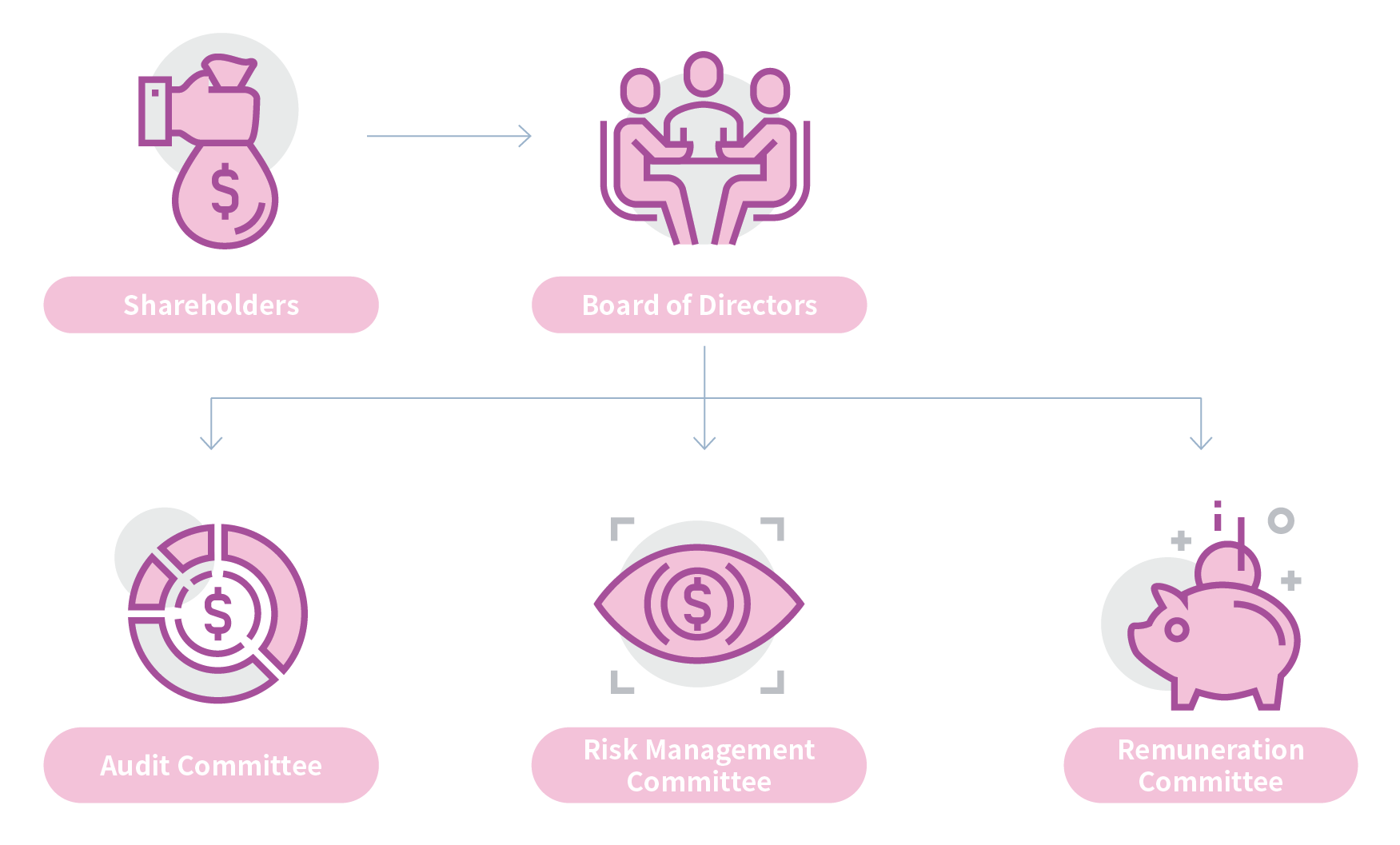

The shareholders’ meeting is the highest authority of WT, while the Board of Directors serves as the highest governing body. The Board, led by the Chairman who acts as the chairperson, oversees the achievement of the Company’s operational goals, enhances business performance, provides strategic guidance to the management team, and ensures compliance with relevant laws and regulations, thereby safeguarding the best interests of the shareholders.

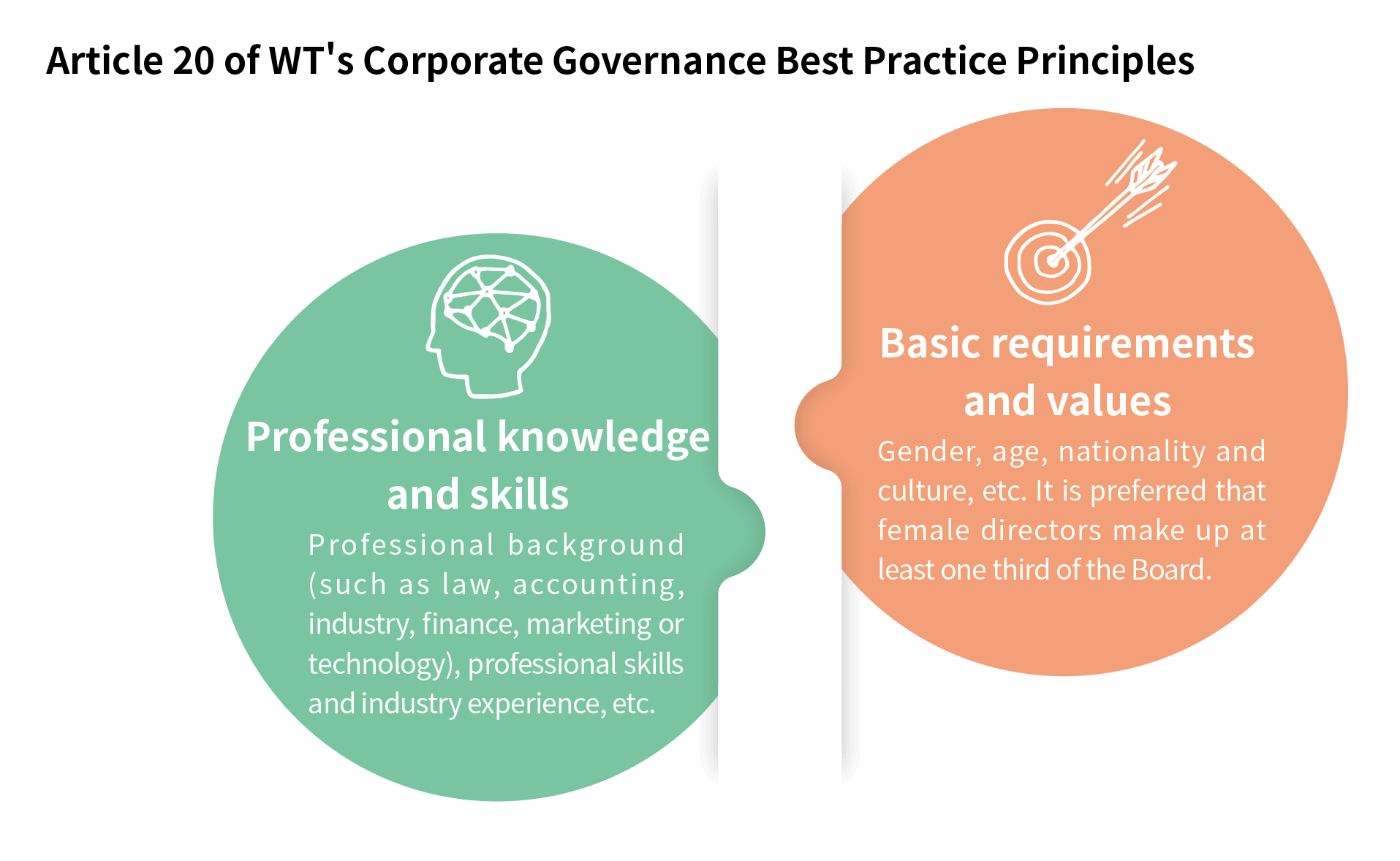

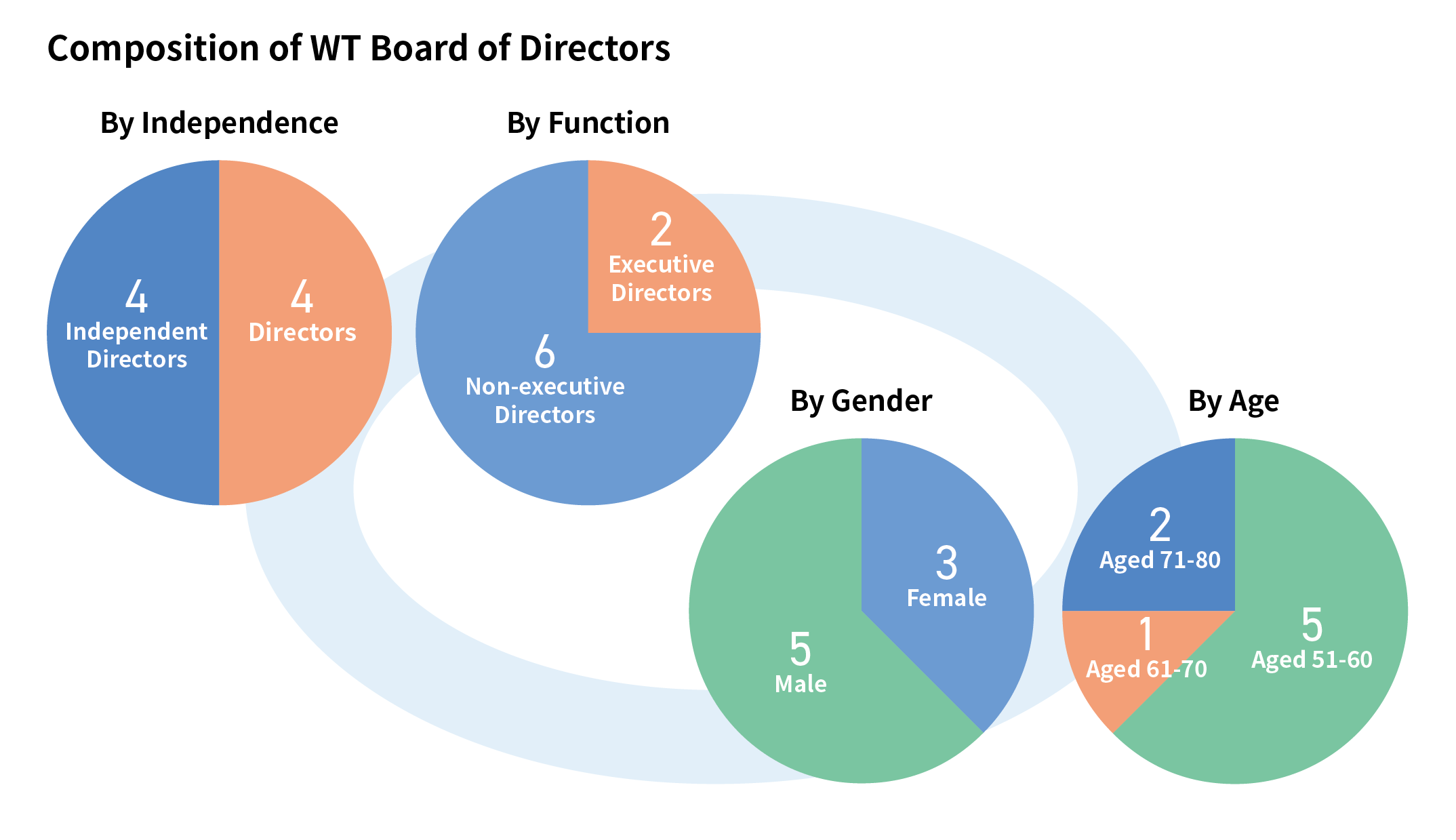

WT established the “Corporate Governance Best Practice Principles” to strengthen the Board’s functions. Besides emphasizing Directors’ professional knowledge, skills, and qualities, the Company implements a policy of board diversity, which requires that Independent Directors constitute no less than one-third of all Board seats to ensure governance independence. Competent Directors are elected at the shareholders’ meeting through a candidate nomination system in accordance with the “Rules for Directors Election“.

Functional committees enhancing governance

To optimize the quality of board decisions-making and enhance its supervisory functions, various functional committees are established under the Board of Directors based on their respective responsibilities. These committees assist the Board in effectively reviewing major corporate matters and monitoring the implementation of its resolutions. The functional committees include the Audit Committee, Remuneration Committee, Nominating Committee, and Sustainable Development Committee. Each committee is accountable to the Board and submits proposals for board resolution.

In 2019, WT’s Board of Directors approved the appointment of a Corporate Governance Officer, who is responsible for matters related to Board and shareholders’ meetings, as well as assisting Directors in their orientation, continuing training, performing of duties, and compliance with regulations. For detailed information, please refer to the Implementation of Corporate Governance in 2024.

Composition and functioning of the Board

To meet the management needs of global expansion and promote board diversity, one additional Director was elected at the 2024 Annual General Meeting, bringing the total number of Board members to 9, including 4 Independent Directors. For details on the implementation of the board diversity policy, please refer to the Corporate Governance section on WT’s official website.

The Board of Directors holds at least one meeting per quarter. In 2024, a total of 13 Board meetings were convened, with an overall Director in-person attendance rate of 92.7%, and a 100% personal attendance rate by Independent Directors.

All proposals submitted to the Board in accordance with the 9 categories specified in the “Rules of Procedure for Board of Directors’ Meetings”, including items such as business plans, financial reports, acquisition or disposal of significant assets, amendments to internal controls and key internal regulations, and the issuance of equity-related securities. For details on major resolutions approved by the Board in 2024, please refer to the Major Resolutions under Corporate Governance section on WT’s website.

Independent Director: 4

Director: 5

Executive Director: 3

Non-Executive Director: 6

Female: 3

Male: 6

Aged 51-60: 5

Aged 61-70: 1

Aged 71-70: 3

To mitigate potential conflicts of interest arising from the Chairman concurrently serving as a managerial officer, as well as other Directors with conflicts of interest, WT follows Article 15 of the “Rules of Procedure for Board of Directors’ Meetings” regarding the recusal mechanism for Directors with conflicts of interest. WT discloses details of proposals involving Directors’ interests in its annual report, including the content of each proposal, the names of the Directors involved, and the reasons for their recusal.

Each year, WT arranges for Directors to attend professional training programs offered by external institutions, such as the Securities and Futures Institute. In addition, the Company irregularly provides updates on corporate governance and regulatory developments to enhance the Board’s operational effectiveness. In 2024, WT held four Director training sessions, all conducted entirely in English in response to globalization trends.

| Lecturer | Course Title | Course Content |

| Mr. Colley Hwang ⎯ (Founder and Chairman of DIGITIMES) | Global ICT Supply Chain and the Evolved Semiconductor Industry | Provided in-depth analysis on the outlook trends of the global ICT supply chain and the evolved semiconductor industry, the exponential growth and business opportunities of the industry, the evolution of division and decentralized manufacturing, as well as issues related to artificial intelligence and geopolitics. |

| Mr. Chih-Cheng Hsieh ⎯ Assurance Partner and Accounting Consulting Service Leader, PricewaterhouseCoopers | How to read and analyze financial statements | Analyzed business fundamentals and growth potential, explored ways to create operational value, and learned to identify early warning signs of risk and prevent financial misstatements by studying case examples of other companies’ financial statements. |

| Mr. Daniel Liang ⎯ General Manager of TCIC Global Certification LTD | A Global Trend on AI Governance | Provided an overview of global trends in AI governance, with an analysis of the key areas of focus by the International Organization for Standardization (ISO) in developing AI management systems, and shared the identification and mitigation of security threats and privacy risks associated with AI systems. |

| Mr. Sean Lee ⎯ Chief Information Security Officer, SinoPac Holdings | X-Tech:The Strategy and Thinking of Cybersecurity | Provided a systematic introduction to information security and corporate information security management. Drawing on the lecturer’s extensive practical experience, the session highlighted the evolution and trends of information security and emphasized the importance of prevention. |

In addition, Independent Directors actively participated in discussions within various functional committees and provided recommendations to the board, thereby reinforcing corporate governance practices.

For detailed information on the composition of the Board of Directors, the Audit Committee, and other functional committees in 2024-including members’ age ranges, professional backgrounds, terms of service, and concurrent positions in other companies, as well as data on Board meeting attendance, continuing training, and the implementation of conflict of interest recusal, please refer to Chapter 2: Corporate Governance Report in WT’s 2024 Annual Report.

100% attendance by Audit Committee members

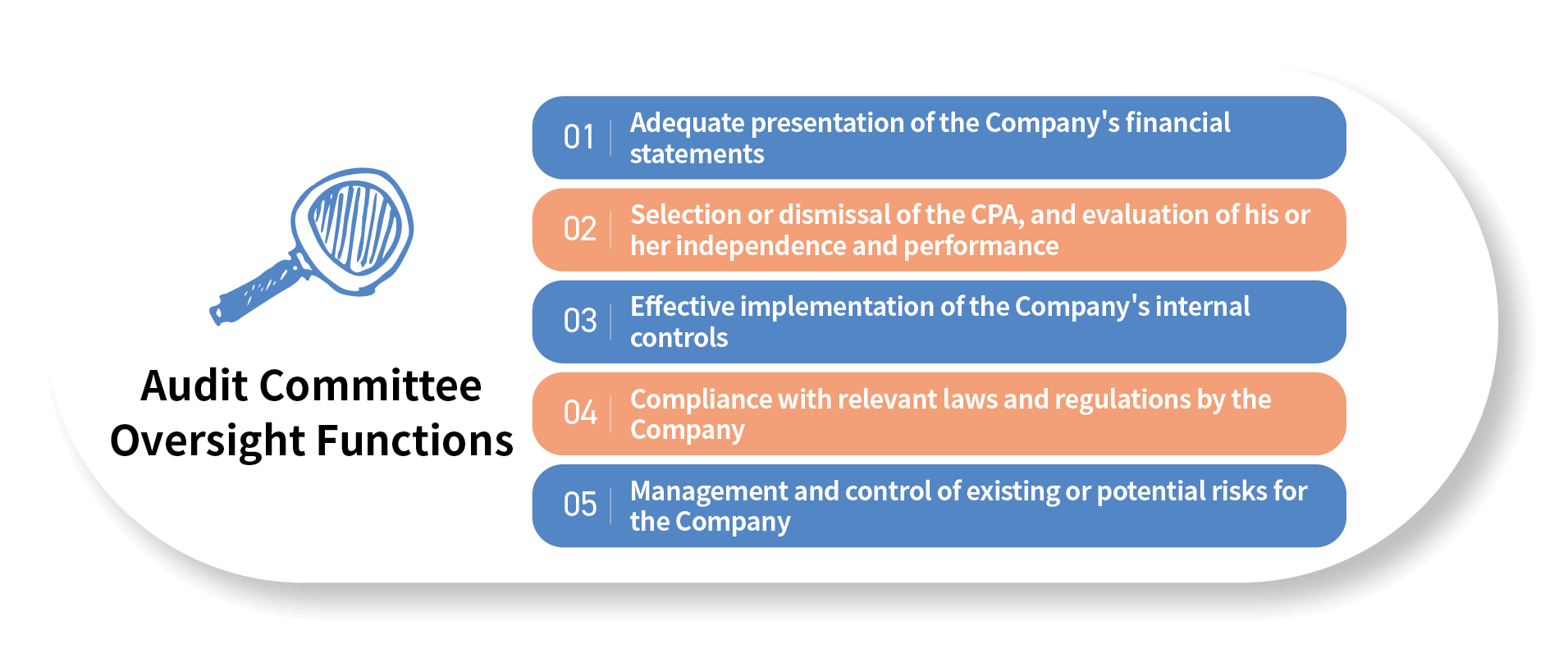

The Audit Committee is composed entirely of Independent Directors, with four members serving in 2024. Mr. Kung-Wha Ding served as both the convener and chairperson. The Committee convenes at least once per quarter. The CPA is required to communicate with the Independent Directors throughout the audit process, including planning, auditing, and reviewing the results. The Internal Auditing Officer also reports on the implementation status and other matters to the Audit Committee at every non-emergency meeting. In 2024, a total of 13 Audit Committee meetings were held, with a 100% in-person attendance rate by all members. For further details, please refer to the “Operation of the Audit Committee in 2024”. In response to regulatory amendments, the “Audit Committee Charter” was revised in 2024 to strengthen the authority of Independent Directors and enhance the procedural framework of the Audit Committee.

Audit Committee Oversight Functions

| 01 | Adequate presentation of the Company’s financial statements |

| 02 | Appointment, dismissal, and assessment of the CPA’s independence and competence |

| 03 | Effective implementation of the Company’s internal controls |

| 04 | Compliance with relevant laws and regulations by the Company |

| 05 | Risk management of existing or potential risks faced by the Company |

Improved executive compensation management system

The Remuneration Committee is composed of three Independent Directors. The purpose of the Committee is to take into account the Company’s operational performance, make objective and professional recommendations to the Board, and assist the Board in implementing and evaluating the Company’s overall compensation and welfare policies. In addition, the remuneration of directors and executives is determined and reviewed in accordance with the Director and Functional Committee Remuneration Payment Guidelines and the Regulations Governing Compensation Payment of Executive Officers as necessary to strike a balance between sustainable management and risk control. In 2024, a total of six Remuneration Committee meetings were held with all members having a 100 percent in-person attendance rate. For detailed information, see the Operation of the Remuneration Committee in 2024.

The Regulations Governing the Share Ownership of the CEO and Non-Executive Directors in 2023 to encourage the CEO and non-executive Directors (excluding Independent Directors) to hold an appropriate amount of the Company’s stocks for a long period, so that their performance could be consistent with shareholders’ interests and they could share the Company’s operating results with shareholders.

The Compensation and Clawback Policy for Executive Officers was formulated in 2023 and adopted by the Board in 2024, which formally include environmental and social operational performance into the Executive Officers’ compensation evaluation criteria. In particular, environmental and social performance each account for ten percent respectively. In addition, to prevent executives from engaging in behaviors that exceed the Company’s risk appetite for higher remuneration, the Policy also stipulates that in cases where a manager’s misconduct leads to a major violation of laws or regulations, and causes a significant risk loss or a need for recompiling financial statements, the Company will recover the excess rewards and significant risk loss incurred by current or former managers due to their misconduct. The content and reasonableness of the above-mentioned remuneration and the difference to be recovered must be reviewed by the Remuneration Committee before submission to the Board for discussion and approval. The remuneration system shall also be reviewed in a timely manner based on operating situation and relevant laws and regulations.

In 2024, the General Manager’s total annual pay was 18.4 times of the median of that of the employees (excluding the General Manager) who have worked for more than six months in 2024 at the Taiwan headquarters and the four subsidiaries including Morrihan, Nuvision Technology, Maxtek Technology, and Techmosa. After calculating the year-over-year percentage change in compensation for each employee, the values were ranked and the median was identified. The ratio of the General Manager’s compensation growth rate to the median compensation growth rate of employees (excluding the General Manager) was 0, as the General Manager’s total compensation remained unchanged in 2024. The median year-over-year growth rate of employee compensation was 6.44%.

Note: Only the employees who have been employed throughout both 2024 and 2023 were taken into account for the median calculation to prevent discrepancies between the statistical median and the actual situation caused by issues such as incomparability of the pay increase of those who have not received a full year’s remuneration in both years (including new hires in 2023 or departures in 2024), and the absence of remuneration increase data for the new hires in 2024.

Both the Sustainable Development Committee and the Nominating Committee comprise a majority of Independent Directors.

The Sustainable Development Committee was established at the end of 2023 to supervise and manage the implementation of sustainable development. The Committee is composed of at least three members appointed by the Board, with more than half must be Independent Directors. In 2024, the Committee consisted of five members: the Chairman, one Director, and three Independent Directors. The first convener and chairperson is Director Kerry Hsu. Two functional teams were established under the Committee: Sustainable Development Team, led by Chief Sustainability Officer Willie Sun, and the Risk Management Team, led by Accounting Officer Cheryl Yang. These teams work together to integrate risk management mechanisms into the promotion and implementation of sustainability initiatives.

The Nominating Committee was also established at the end of 2023 to assist the Board in the fair and transparent selection and evaluation of suitable candidates for directorship, as well as to assess the independence of Independent Directors. The Committee shall be composed of at least three Directors appointed by the Board, with more than half must be Independent Directors. In 2024, the Committee consisted of three members: the Chairman and two Independent Directors. The first convener and chairperson is Chairman Eric Cheng. The Nominating Committee also assists the Board of Directors in reviewing the performance evaluations of the Board itself, its functional committees, and individual Directors, as well as in planning and implementing Director development programs.

WT formulated the “Rules for Board of Directors Performance Assessments” in 2016, which clearly stipulates that the Board shall be evaluated at least once a year, and that its performance must additionally be assessed once every three years by an external, professional, and independent institution or a team of external experts or scholars. The assessment results must be reported to the Board and used as a reference for determining individual Directors’ remuneration and nomination for the Board re-election.

Four Board of Directors Assessment Aspects

| 01 | The Board’s professional competencies |

| 02 | The effectiveness of the Board’s decision-making |

| 03 | The Board’s attention to and supervision of internal controls |

| 04 | The Board’s attitude toward corporate social responsibility |

In 2023, the Taiwan Institute of Ethical Business-an external professional institute, was commissioned to assess the Board’s performance. The Institute and its executive experts maintain independent and have no business relationship with WT. The assessment was conducted through document reviews, questionnaires, and on-on-one interviews with the Directors in four major aspects. Two concrete recommendations were made: (1) Enhance the Independent Directors’ understanding of the operations of overseas subsidiaries and strengthen their interaction with the executives; (2) Continue to implement the Company’s sustainable management goals. The internal and external assessment results were reviewed and approved at the Board meeting held on February 16, 2024, which agreed to optimize WT’s corporate governance implementation by making the recommended improvement. For further details, please refer to “The implementation of external board performance evaluations”.

The execution results of the 2024 internal performance evaluations for Individual Directors, the overall Board of Directors, and each functional committee of WT were approved by both the Nominating Committee and the Board on February 25, 2025. For more detais, please refer to “Chapter 2: Corporate Governance Report” in WT’s 2024 Annual Report.

Rigorous internal audits to ensure fairness and impartiality

❙ Independence: The internal audit unit is an independent unit under the Board of Directors and reports directly to the Board. The appointment and dismissal of the Chief Internal Auditor shall be approved by the Audit Committee and resolved by the Board of Directors. The appointment, dismissal, performance evaluation, and remuneration of internal audit personnel shall be handled in accordance with the Company’s Corporate Governance Best Practice Principles. Such matters shall be submitted by the Chief Internal Auditor to the Chairperson for approval, and performance evaluations shall be conducted annually.

❙ Purpose of internal audit: The purposes of internal audit are to assist the Board of Directors and managers in inspecting and reviewing defects in the internal control systems, measuring operational effectiveness and efficiency, and to make timely recommendations for improvements to ensure the sustained operating effectiveness of the systems and to provide a basis for review and correction.

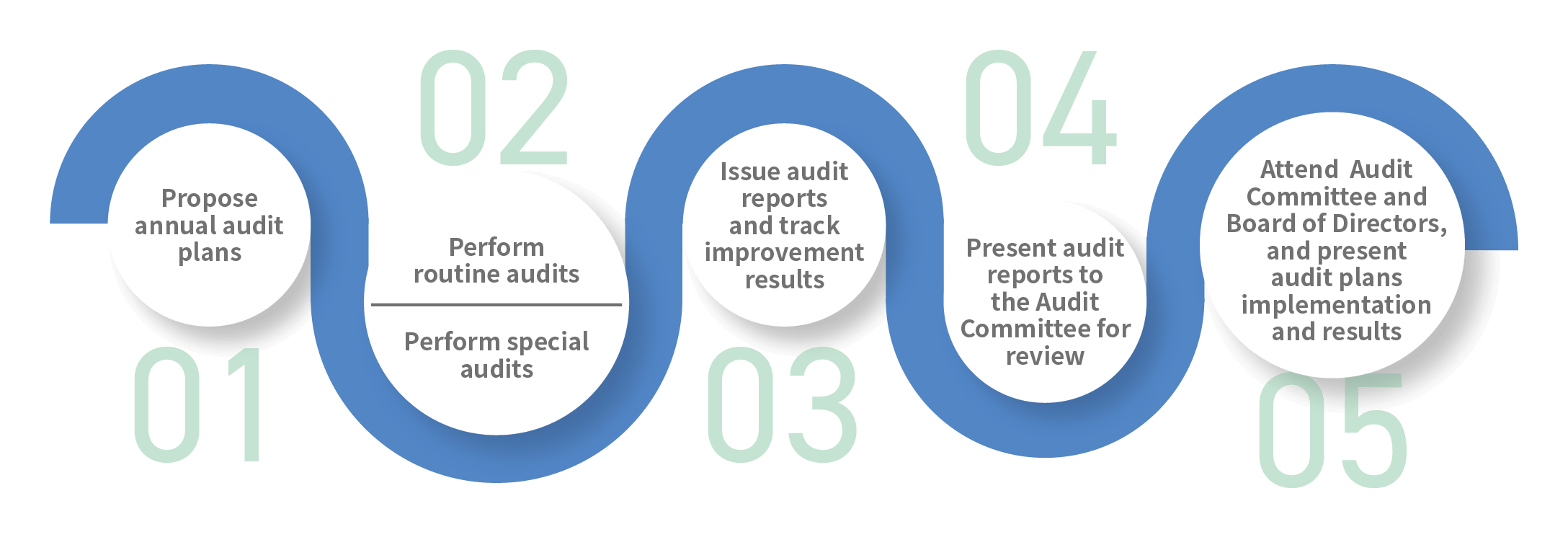

Propose annual audit plans

Strengthening institutional agility through self-supervision

❙ Internal audit activities: Internal audit work is primarily conducted in accordance with the annual audit plan approved by the Board of Directors. This plan is formulated based on identified risks and includes routine audits. Special audits may be conducted as necessary. After implementing each audit, the Internal Audit Department shall present the audit reports and follow-up reports, and submit them for review by the Audit Committee before the prescribed statutory date. The audit supervisor shall attend regular Audit Committee and Board meetings to report on the status and results of audit execution.

❙ Self-assessments: All internal departments and subsidiaries are to conduct self-assessments once a year and implement the Company’s self-monitoring mechanism. The design and implementation of the internal control system are adjusted in a timely manner in response to changes in the environment. The self-assessment reports are reviewed by internal auditors, and the self-assessment results and audit discoveries provide a basis for the Board and General Manager to produce Internal Control System Statements.

❙ Management of sustainability information: WT has established an internal control system for the management of sustainability information in accordance with the “Regulations Governing the Establishment of Internal Control Systems by Public Companies”. The preparation of the sustainability report is incorporated into the internal control system for proper oversight and management. The Company’s management fulfills its duty of care as a prudent administrator to ensure the quality of the sustainability report.

Corporate Governance Milestones in 2024

∙ Ranked in the top 5% of all TWSE/TPEx-listed companies and top 10% among electronic companies with a market capitalization over NT$10 billion in the 11th Corporate Governance Evaluation (fifth consecutive year)

∙ Independent Directors completed an average of 11.3 hours of continuing training; all Directors averaged 10.3 hours.

∙ Across 13 Board meetings, the average in-person attendance rate of Independent Directors was 100%, and 92.7% for all Directors.

∙ Audited parent company only and consolidated financial statements were announced within 56 days after the fiscal year-end (statutory deadline: 75 days); quarterly consolidated financial statements reviewed by CPAs were announced within an average of 37 days after each quarter-end (statutory deadline: 45 days).

∙ Held 12 physical or online investor conferences.

∙ WT cooperated with the Zhonghe Precinct of the New Taipei City Police Department to promote anti-fraud awareness to shareholders attending the 2024 Annual General Meeting.

∙ WT held its 2024 Annual General Meeting in a hybrid format, enabling virtual participation to advance shareholder engagement and strengthen corporate governance.

To reduce the possibility of conflicts of interest between the Chairman and the other Directors, WT discloses information including the content of the items, the names of the interested Directors, and reasons for recusals in the annual reports, as required by Article 15 of the Rules of Procedure for Board of Directors’ Meetings. In addition, in compliance with the requirements of Taiwan Stock Exchange Corporation Operation Directions for Compliance with the Establishment of Board of Directors by TWSE Listed Companies and the Board’s Exercise of Powers, at least half of the Board Members are Independent Directors, and more than half of them are neither employees nor executives. Every year, WT arranges for each Director to attend professional director courses provided by external organizations such as Taiwan’s Securities and Futures Institute to improve the Board’s operational effectiveness. To implement corporate governance, Independent Directors may provide input and make suggestions in each functional committee for the Board’s information. In addition, information such as the existence of controlling shareholders and related party transactions is disclosed in the annual reports.

To reduce the possibility of conflicts of interest between the Chairman and the other Directors, WT discloses information including the content of the items, the names of the interested Directors, and reasons for recusals in the annual reports, as required by Article 15 of the Rules of Procedure for Board of Directors’ Meetings. In addition, in compliance with the requirements of Taiwan Stock Exchange Corporation Operation Directions for Compliance with the Establishment of Board of Directors by TWSE Listed Companies and the Board’s Exercise of Powers, at least half of the Board Members are Independent Directors, and more than half of them are neither employees nor executives. Every year, WT arranges for each Director to attend professional director courses provided by external organizations such as Taiwan’s Securities and Futures Institute to improve the Board’s operational effectiveness. To implement corporate governance, Independent Directors may provide input and make suggestions in each functional committee for the Board’s information. In addition, information such as the existence of controlling shareholders and related party transactions is disclosed in the annual reports.